Vehicle Wrap ROI: Measuring Visibility, Impressions & Business Impact

Wraps Feel Powerful, But Are They Really Paying You Back?

Every day, your vehicles move through neighborhoods, business districts, and high-traffic corridors. People often see them at traffic signals, in parking lots, and outside customers’ homes. Even when parked overnight, they sit where thousands of eyes pass by.

The exposure is constant, yet for most businesses, the actual impact of that visibility is still a mystery.

Vehicle wraps are often described as one of the most cost-effective marketing channels. Still, that claim only matters when you understand what’s actually happening between the moment someone notices your branded vehicle… and the moment they become a paying customer.

That’s where many teams get stuck.

It’s not enough to quote “impressions.”

It’s not enough to say “wraps last 5–7 years.”

None of that tells you:

- How many people are truly seeing your vehicles

- Which routes and parking habits multiply your visibility

- How design choices influence whether someone takes action

- How many leads and customers do your vehicles realistically generate

- Whether your wrap investment outperforms digital ads, billboards, or other local marketing

Put simply:

Your fleet already delivers visibility, real ROI comes from knowing how to measure it.

Modern brands treat vehicle wraps as more than graphics. They treat them as mobile, always-on media assets that can drive measurable business value. Once you understand how visibility becomes impressions, how impressions become inquiries, and how those inquiries become revenue, your wrapped vehicles stop feeling like “branding” and start operating like one of the most reliable profit engines in your marketing mix.

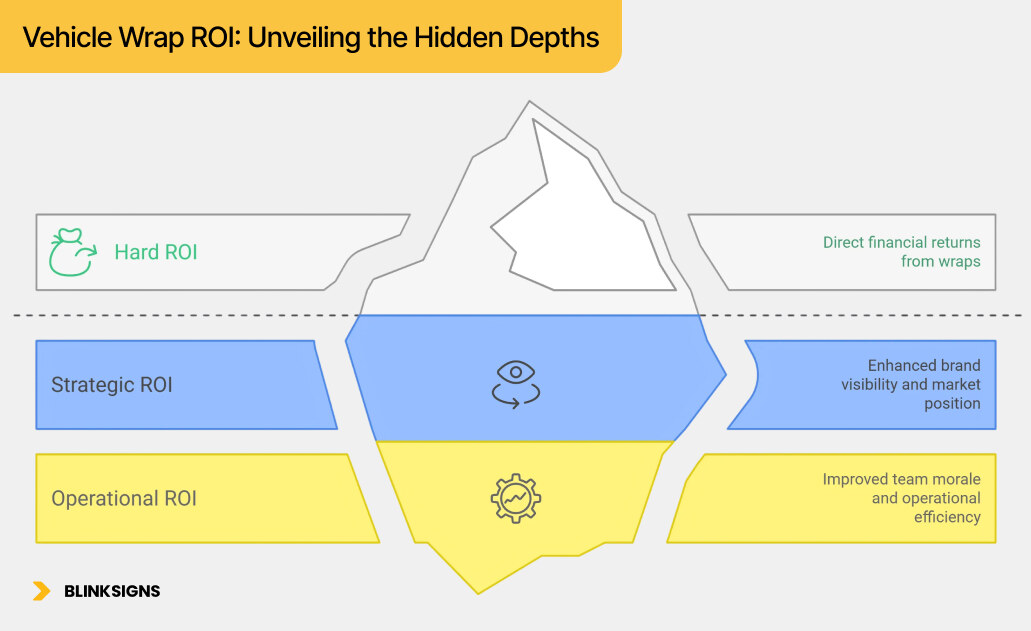

What “ROI” Really Means for Vehicle Wraps (And Why Most Businesses Misread It)

Vehicle Wrap ROI_ Unveiling the Hidden Depths

The Three Layers of Vehicle Wrap ROI

When most people say “vehicle wrap ROI,” they usually mean just one thing:

“If I spend $X, how much revenue do I get back?”

That’s important, but it’s only one layer.

You can think of vehicle wrap ROI in three layers:

- Hard ROI (Financial)

This is the direct, measurable layer:

- New calls, quotes, jobs, and contracts that started with your vehicles

- Revenue, profit, payback period, and customer lifetime value

- Example: “We spent $3,500 on a wrap and closed $24,000 in tracked jobs over 3 years.”

- Strategic ROI (Brand & Market Position)

This is about how visible and credible you look in your service area:

- Whether people recognize your name when they finally need your service

- Whether your fleet looks like the “obvious choice” compared to unmarked vans

- How often are your vehicles seen in the right neighborhoods?

- Operational ROI (Team & Operations)

This is the internal, often overlooked layer:

- Pride and professionalism—staff feel better driving branded vehicles

- Recruitment signal—wrapped fleets suggest stability and growth.

- Accountability—drivers know they represent the company wherever they go

Most competitors and basic articles only talk about impressions and CPM (cost per thousand impressions). Helpful, but:

- Impressions alone ≠ revenue

- CPM alone ≠ payback period

- A pretty wrap with no tracking ≠ proof

Common ROI Mistakes Businesses Make

Here’s where measurement often goes off the rails:

Stopping at impressions

“40,000 impressions a day” sounds impressive, but if you don’t know how many of those turn into calls or customers, that’s not ROI, it’s just potential.

No attribution at all

New leads get recorded as “Google,” “referral,” or “don’t know,” even when the first tangible touchpoint was a wrapped vehicle parked on their street every week.

Ignoring the journey

A customer may see your van 3–4 times before searching your name online. If you only look at the final click, the wrap gets zero credit.

Single-scenario thinking

Vendors love one-off examples like “this wrap generated 1,000% ROI.” That might be true for one case, but it doesn’t give you a realistic best/worst/expected range for your own situation.

A better approach is a funnel-based model that connects:

Visibility → Impressions → Responses → Leads → Customers → Profit

From Visibility to Revenue: How Vehicle Wrap ROI Actually Works

The 6-Stage ROI Funnel for Vehicle Wraps

Almost every wrap-driven result can be mapped through six stages:

- Visibility

- Where your vehicles drive

- When they’re on the road

- Where they sit when parked

- Local traffic patterns and density

- Where your vehicles drive

- Impressions

- How many people actually see your vehicle

- Driven by miles, route type (urban vs. rural), and time of day

- How many people actually see your vehicle

- Response Actions

- Calls to the number on your wrap

- Direct visits to your web address

- QR code scans

- People searching for your brand after repeated exposure.

- Calls to the number on your wrap

- Leads

- Qualified people who call, submit a form, or request a quote

- Qualified people who call, submit a form, or request a quote

- Customers

- Leads that turn into paying jobs or contracts

- Leads that turn into paying jobs or contracts

- Profit

- Revenue from those jobs

- Minus the cost of goods, labor, and the wrap investment

- Revenue from those jobs

One simple way to hold this in your mind:

Visibility conditions → Impressions → Responses → Leads → Customers → Profit

A Realistic Example: Single Van, Local Service Business

Let’s examine a realistic example of a plumbing company operating one wrapped van.

Assumptions:

- 1 wrapped van

- 50 miles per day, 26 days/month

- Mostly urban/suburban roads

- Wrap cost: $3,000, lifespan 5 years

- Average job value: $800

- Gross profit margin: 40%

1) Visibility & Impressions

For a mixed urban/suburban environment, a reasonable working assumption is about 800 impressions per mile (a midpoint between 500–900+, depending on the exact route).

- Daily impressions

50 miles × 800 = 40,000 impressions/day

- Monthly impressions

40,000 × 26 ≈ 1,040,000 impressions/month

- 5-year impressions

1,040,000 × 60 ≈ 62,400,000 impressions

Even if the actual count varies month to month, we’re clearly dealing with tens of millions of impressions over a wrap’s lifespan.

2) Responses

Not everyone who sees your van is ready to call. For passive exposure, a more realistic baseline response rate is:

- 0.002% (1 in 50,000 impressions)

So:

- Monthly responses

1,040,000 × 0.00002 ≈ 21 responses/month

Some of those will be weak or unqualified:

- Assume 70% are solid leads → around 15 leads/month

3) Leads → Customers

If the plumbing company closes:

- 30% of leads into customers

Then:

- Monthly customers from the wrap:

15 × 0.3 ≈ 4–5 customers/month

That’s around 50–60 customers/year from a single wrapped van, driven solely by wrap visibility.

4) Revenue & Profit

Each of those wrap-driven customers is worth:

- Average job: $800

- Gross profit margin: 40%

- Profit per job: $320

If we use 50 customers/year as a round figure:

- Annual profit from wrap-driven jobs

50 × $320 = $16,000 profit/year

- 5-year profit

$16,000 × 5 = $80,000 profit from that one van

Total investment might be:

- Wrap: $3,000

- Maintenance over 5 years (cleaning, touch-ups): ~$750

- Total wrap investment ≈ $3,750

5) ROI & Payback

- Net profit = $80,000 − $3,750 = $76,250

- ROI % ≈ ($76,250 ÷ $3,750) × 100 ≈ 2,000%+ ROI over 5 years

- Payback period: $3,750 ÷ ~$1,333 monthly profit ≈ 3 months

Even with conservative response rates, a single well-used wrap can pay for itself in a few months and continue generating profit for years, if the business gets routes, design, and tracking right.

Estimating Impressions: Traffic, Routes & Parking Strategy

This is where many vehicle wrap ROI conversations get oversimplified. Two companies can both “have wraps,” spend similar amounts, and operate in similar markets, yet see very different results.

The difference often comes down to where vehicles move, when they move, and where they rest.

Branded Vehicle on a Rural Route

Route Environment: Urban vs. Suburban vs. Rural

A practical way to estimate impressions is:

Impressions per mile × miles driven = daily impressions

Different environments produce very different impressions per mile:

| Route Type | Impressions per Mile (Typical Range) | Why It Matters | Best For |

| Urban high-traffic | 1,000–1,500 | Dense cars, signals, pedestrians, and slower speeds | Consumer services, retail, food, and home trades |

| Suburban mixed-use | 500–900 | Good volume, mix of homes and businesses | HVAC, plumbing, landscaping, pest control |

| Highway/freeway | 250–500 | Higher speed, less dwell time, but substantial vehicle volume | Delivery, regional B2B, long-distance |

| Rural/industrial | 100–300 | Sparse vehicles, low density | Niche industrial and agricultural |

Two simple implications:

- Urban + suburban routes usually create more impressions for the same mileage.

- Long stretches of rural or low-density industrial driving increase your effective CPM, as fewer people see the wrap.

Time-of-Day: When You Drive Changes ROI

The same road can deliver different value depending on when you travel it.

| Time Period | Traffic Level | Visibility Quality | Effect on Impressions |

| Morning rush (6–9) | Very high | Stop-and-go, repeat exposure | ~1.3–1.5× baseline |

| Midday (9–3) | Medium | Steady traffic, decent viewing | Baseline (1.0×) |

| Evening rush (4–7) | Very high | Commute traffic, repeat viewers | ~1.3–1.5× baseline |

| Late evening/night | Low (most areas) | Poor lighting unless well-lit | ~0.3–0.5× baseline |

| Weekends | Variable | High near malls/events, low in business districts | ~0.8–1.2×, depends on area |

You don’t need a new business model—just a bit more intention:

- Stack more jobs so that a larger portion of the drive time happens during rush hours on high-traffic corridors.

- Push low-urgency trips into time windows that naturally give more visibility for the same fuel and labor.

A few scheduling adjustments can deliver 30–50% more exposure without adding vehicles.

Parking Strategy: Your 24/7 Mobile Billboard

Drive time is only half the story. Your vehicles are parked for 12 hours or more a day. That’s either:

- Free, continuous impressions, or

- Wasted potential in a hidden yard or private garage

Different parking choices have very different impacts:

| Parking Location | Nightly Impressions (Typical) | Annual Extra Impressions | Estimated ROI Impact |

| Street-facing in a busy residential area | 1,500–3,000 | 550k–1.1M | +15–20% visibility |

| Parked at the job site, visible from the street | 1,000–2,000 | 365k–730k | +10–15% in target areas |

| Driveway in a moderate traffic area | 500–1,000 | 180k–365k | +5–8% |

| Company yard behind building/garage | 0–100 | 0–36k | Minimal extra impact |

Two simple policy changes can materially shift your wrap ROI:

- Encourage technicians to park wrapped vehicles street-facing when it’s safe and permitted, not hidden behind buildings or shut inside closed garages.

- At job sites, park where the vehicle is visible from the street without blocking neighbors or driveways.

Over the course of a year, this can result in hundreds of thousands of impressions per vehicle, particularly in densely populated suburban and urban areas.

Territory & Seasonal Patterns

The last piece of the visibility puzzle is where your vehicles spend their time:

- Do your routes frequently pass through high-income neighborhoods that match your ideal client?

- Are you often near schools, retail centers, or corporate districts?

- Are there seasonal patterns you can lean into?

Examples:

- HVAC or plumbing

- Focus more drive time in homeowner-dense, older housing areas where systems fail more often.

- During heat waves or cold snaps, visibility in those areas lines up with peak demand.

- Focus more drive time in homeowner-dense, older housing areas where systems fail more often.

- Landscaping or lawn care

- Early morning and late afternoon pass through neighborhoods where you already serve clients, reinforcing the idea that “everyone here uses them.”

- Early morning and late afternoon pass through neighborhoods where you already serve clients, reinforcing the idea that “everyone here uses them.”

- Catering, food trucks, event services

- Routes and parking near event venues, stadiums, markets, and seasonal fairs can dramatically increase targeted exposure.

- Routes and parking near event venues, stadiums, markets, and seasonal fairs can dramatically increase targeted exposure.

You don’t need complex software. A basic map with:

- Highlighted high-value neighborhoods

- High-traffic corridors marked

- Known event hotspots and commercial hubs

…is often enough to guide drivers toward the parts of the territory where impressions matter most.

Turning Impressions Into Leads: Tracking What Your Wraps Actually Do

Most businesses lose wrap ROI not because the graphics are bad, but because nothing is in place to capture and attribute what the wraps are already doing.

A simple tracking stack gives you three advantages:

- Proof that your wraps are responsible for real leads

- Insight into which routes, designs, and vehicles perform best

- Confidence to invest more where it actually pays off

Tracking Vehicle Wrap ROI

Step 1: Use a Dedicated Phone Number

A unique phone number printed only on your vehicles is one of the cleanest ways to track response.

- Get a tracking number from a call tracking platform or carrier.

- Forward it to your main office line so operations stay the same.

- Don’t use that number on your website, social profiles, or print ads—just on the vehicles.

Now, any calls to that number are high-confidence wrap leads.

Typical monthly numbers (per active vehicle):

- 5–15 calls/month for home services and local trades in busy markets

- Receiving fewer than three calls/month is a sign to review routes, design, or visibility.

Step 2: Add a Dedicated Landing Page or Short URL

Some people prefer to type in a web address instead of calling.

Give them a simple, memorable path:

- YourBrand.com/truck

- YourBrand.com/local

- Or a subdomain like wrap.YourBrand.com

On that page:

- Mirror the message from the vehicle (“Saw our truck? Here’s your offer.”)

- Make calling or booking easy (tap-to-call, short forms, quote buttons).

- Add analytics with clear parameters, such as

?utm_source=vehicle_wrap&utm_medium=offline.

Healthy ranges:

- 20–50 visits/month per active vehicle

- 5–10% of those visits turn into inquiries or bookings

Step 3: Keep Asking “How Did You Hear About Us?”

A simple habit still works:

“How did you hear about us?”

Make sure “saw your truck/van” or “saw your vehicles” is a named option in your CRM or intake form—not just “Other”.

Over time, you’ll see patterns:

- How often are wraps mentioned

- Which neighborhoods or job types generate the most wrap-driven leads

- Whether design/route changes move those numbers

Step 4: Add a QR Code for Mobile-First Actions

For some audiences, a quick scan is easier than a phone call.

Done well:

- Use a dynamic QR (Bitly, Uniqode, etc.) so you can update the destination without reprinting the wrap.

- Point it to a tracked offer like:

YourBrand.com/truck-offer?utm_source=vehicle_wrap&utm_medium=qr.

- Make it at least 4” × 4”, so it can be scanned from a few feet away.

- Place it where people naturally walk or stand near the vehicle—on the rear panel, near the side door area, or on the fuel side when parked.

As a rough guide:

- 10–30 scans/month per active vehicle is a good sign in busy areas.

- Consistently under five suggests the QR is too small, too low, or not visible where you usually park.

Step 5: Understand Multi-Touch Attribution (So Wraps Don’t Disappear in Reports)

In reality, most customers don’t move from “first sight” to “phone call” in one step.

A typical journey:

- I see your wrapped van on the main road near home

- Notices it again at a neighbor’s house a few days later

- Weeks later, search for your brand name when you encounter an urgent problem.

- Clicks your website and calls the number there

If you only rely on last-click data in analytics, the website or Google Search gets 100% of the credit—even though the wrap introduced and reinforced your brand.

To avoid undervaluing wraps:

- Treat the vehicle as a top-of-funnel and mid-funnel channel that feeds search and direct traffic.

- Use first-touch style questions (“Where did you first hear about us?”) along with “What made you contact us today?”

- Combine that qualitative information with call tracking and landing page data to gain a comprehensive understanding.

You don’t need enterprise software. A dedicated number, a short URL, one QR code, and one survey question are often enough to reveal that your fleet is quietly driving more business than anything else offline.

Design Decisions That Make or Break Your ROI

You can get routes and parking right, but still miss a lot of potential if your design is difficult to read at 40 mph or if your contact details are too small.

Two vans, same mileage, same city, exact wrapping cost. One consistently receives four calls a month, while the other receives 10–12. In many cases, that difference is down to design.

Vehicle wrap design for US Storage truck

The 5-Point Design Effectiveness Scorecard

Here’s a simple way to think about design and ROI:

| Element | Weak Design (Hurts ROI) | Strong Design (Supports ROI) | Impact on Response |

| Contact method visibility | Small phone, no clear web, QR hidden low | Phone number 12–15” tall, clear URL, QR at eye level | 2–3× more responses |

| Readability at speed | Script fonts, low contrast, dense text | Bold sans-serif, high contrast, short phrases | 40–60% better recall |

| Logo & brand prominence | Tiny logo in a corner, generic stock imagery | Logo occupies 20–25% of the main panel, strong brand colors | 50–80% better recognition |

| Message clarity | List of 8+ services, no clear promise or CTA | One main idea + one clear CTA | 30–50% more inquiries |

| Coverage & angles | Small door graphics or magnets only | Full or ¾ wrap visible from both sides and rear | 2–4× more viewing angles |

Two or three weak elements can quietly cut your conversion rate in half.

Quick Design Scorecard: Is Your Wrap Built to Convert?

Score each element from 1 (poor) to 5 (excellent). Add up your total at the end.

| Design Element | Minimum Standard | Your Score (1–5) |

| Phone number size | At least 12” tall on sides and rear; easy to read from 50+ feet | ⬜ |

| Phone number placement | Not squeezed into a corner; placed at natural eye level in traffic | ⬜ |

| URL simplicity | Short and memorable (YourBrand.com, no long paths or slashes) | ⬜ |

| Core message length | One central idea, 10 words or fewer | ⬜ |

| Font choice | Bold sans-serif, no scripts, no thin decorative fonts | ⬜ |

| Color contrast | Strong dark-on-light or light-on-dark contrast | ⬜ |

| Coverage & angles | Key info visible from both sides and rear | ⬜ |

| Logo prominence | Logo and brand mark cover ≥20% of the main panel area | ⬜ |

| White space | At least ~30% of the design is left as clean space (no clutter) | ⬜ |

How to read your score:

- 40–45 → Excellent. Routes and tracking will decide how far you can push ROI.

- 30–39 → Solid, with a few easy wins (usually enlarging phone, simplifying message, improving contrast).

- 20–29 → Design is likely holding you back; you may be losing 30–50% of potential leads.

- Below 20 → Wrap is functioning more as a moving logo than a true marketing asset. A strategic redesign can unlock significant upside.

Before / After: How Design Alone Can 3× Responses

Imagine that the plumbing company has three vans again.

Version A – Weak Design

- Small logo limited to front doors

- Script font and long tagline plus a list of services

- Phone number around 6–8” tall

- No web address or QR code

- Dark blue text on a slightly lighter blue background

Result over time:

- 3–4 calls per month per vehicle, clearly attributed to the vans

Version B – Conversion-Focused Design

- Large logo spanning side panels

- Clear message: “24/7 EMERGENCY PLUMBING”

- Phone number 14–15” tall on sides and rear

- Simple URL such as MetroPlumb.com

- High-contrast colors (white on solid blue, or dark on bright)

- Clean layout with plenty of breathing room

Result in a similar territory:

- 10–12 calls per month per vehicle from people who saw the vans

Same city, similar mileage, same main roads. The difference isn’t “luck”—it’s clarity.

Conservative vs. High-Performance ROI: Three Scenarios to Model

It’s risky to base decisions on a single “hero” example.

A better approach is to model three scenarios using the same type of business and vehicles:

- Conservative – lower mileage, weaker conversion, slightly higher upkeep

- Expected – realistic averages

- High-performance – strong design, good tracking, optimized routes, and parking

For an HVAC company with three vans, the logic might look like this:

| Assumption Variable | Conservative | Expected | High-Performance |

| Daily miles per vehicle | 40 | 50 | 60 |

| Conversion rate (impressions→customers) | 0.005% (half of expected) | 0.010% | 0.015% (excellent setup) |

| Wrap lifespan | 5 years | 5 years | 7 years (excellent maintenance) |

| Annual maintenance cost/vehicle | +10% baseline | Baseline | Slightly lower (preventive care) |

Without doing every line of math here, a pattern emerges:

- Even in the conservative case, the wrap ROI remains comfortably positive, and payback typically occurs within 12–24 months.

- In the expected case, the ROI typically falls within the 300–600% range over 5 years.

- In the high-performance case, optimized fleets can achieve ROI percentages of 4 figures over 7 years.

This is why the goal isn’t just “wrap the van”—it’s to move as far as possible from conservative toward high-performance by improving:

- Routes and parking

- Design clarity and hierarchy

- Tracking and attribution

- Maintenance and lifecycle decisions

Vehicle Wrap ROI Benchmarks by Industry

Different industries experience varying economic conditions—such as job values, margins, repeat work, and contract structures.

The table below gives plausible ranges based on common patterns. It’s not a guarantee, but it’s a helpful reality check.

| Industry | Avg Job Value | Profit Margin | Typical CLV Multiplier* | Est. New Customers/Month per Vehicle | Plausible 5-Year ROI Range |

| HVAC | $4,500 | 30% | 1.5× | 2–4 | 300–600% |

| Plumbing | $800 | 35% | 2.0× | 3–6 | 400–800% |

| Electrical | $1,200 | 40% | 1.8× | 3–5 | 350–700% |

| Landscaping | $2,800 | 40% | 3.0× | 2–5 | 500–1,000% |

| Commercial Cleaning | $450 | 50% | 5.0× | 5–10 | 600–1,200% |

| Pest Control | $350 | 55% | 4.0× | 4–8 | 550–1,100% |

| Catering / Food Service | $1,200 | 25% | 2.5× | 4–8 | 300–600% |

| Legal (Personal Injury) | $15,000 | 30% | 1.0× | 1–2 | 200–500% |

| Real Estate | $12,000 | 25% | 1.2× | 1–3 | 250–600% |

| Retail / Mobile Sales | $650 | 20% | 1.5× | 5–12 | 200–500% |

* CLV Multiplier = Rough indication of how many times, on average, a new customer buys again over the relationship (contracts, seasonal work, maintenance plans, etc.).

If your estimated or measured ROI sits far below these ranges, it’s a sign to:

- Revisit your design (can people actually read it and respond easily?)

- Spend more drive time in high-value corridors and neighborhoods.

- Strengthen tracking, so you see the full impact rather than guessing.g

- Check pricing and margins to confirm there’s enough profit per job to support wrap investment.

How Vehicle Wrap ROI Compares to Other Local Marketing Channels

Many teams eventually ask:

“Are wraps really better than Google Ads, billboards, or mailers?”

Most of the time, wraps don’t replace other channels—they sit beside them as a low-cost, high-trust awareness engine.

Here’s a straightforward comparison using CPM (cost per thousand impressions) and typical characteristics:

| Channel | Typical CPM | Lifespan / Commitment | Ongoing Spend | Local Targeting | Trust & Perception |

| Vehicle Wraps | $0.15–$0.50 | 5–7 years (one-time cost) | None | Excellent in the service area | Very high (real vehicles, real work) |

| Google Search Ads | $2–$12 | Month-to-month | Ongoing | Good (location + keyword) | Medium (clearly labeled as ads) |

| Facebook / Instagram | $1.50–$8 | Campaign-based | Ongoing | Good (geo + interests) | Medium-low (ad fatigue, ad blindness) |

| Billboards | $3–$10 | 4–52 weeks (rental) | Ongoing | Good on major routes | Medium (less personal) |

| Direct Mail | $8–$15 | One-time drops | Per campaign | Perfect (targeted zips) | Low-medium (often treated as junk) |

| Radio | $4–$10 | 4–12 week flights | Ongoing | Broad regional | Medium (background listening) |

Key points:

- Wraps are a capital investment, not a monthly bill. After you pay for the wrap, every mile driven reduces your actual CPM.

- Digital channels cease to function the moment you pause the campaign. Wraps keep working every day your vehicles are on the road, whether you’re actively “running marketing” that month or not.

- For local service brands, wrapped vehicles often become the lowest-cost, highest-trust source of awareness in the entire mix—mainly when supported by search, reviews, and a strong website.

Lifecycle, Maintenance & When to Refresh Your Wrap

Every wrap has a lifespan, and ROI depends heavily on how well you maintain it and when you choose to refresh it. A wrap isn’t just a design—it’s a marketing asset with a measurable performance curve.

Most high-quality wraps last 5–7 years, although not all years perform equally well. Sun exposure, washing habits, parking habits, and climate all influence longevity and impact.

7-Year Vehicle Wrap Lifecycle (What Happens at Each Stage)

Here’s a realistic lifecycle based on thousands of fleet vehicles across major U.S. markets:

| Year Range | Condition | Visual Impact | Performance Level | Recommended Action |

| 0–2 | New, pristine | 100% | Peak visibility, strongest conversion rates | Optimize routes; ensure tracking is set up |

| 2–4 | Excellent | 95–100% | Strong, stable performance | Annual deep cleaning; inspect edges |

| 4–5 | Good | 85–95% | Slight decline; still strong credibility | Plan refresh; budget for next cycle |

| 5–7 | Fair–Good | 70–85% | Noticeable fading; reduced perceived professionalism | Refresh recommended |

| 7+ | Fading/peeling | 50–70% | Negative credibility impact (hurts trust) | Replace immediately |

Once you reach Years 5–7, your wrap may still be technically functioning—but perceived quality drops, and that affects your brand long before the material fails.

Refresh Strategy: When, Why & How to Update Your Wrap

A refresh isn’t simply replacing old vinyl. It’s an opportunity to enhance your ROI by leveraging insights gained from the wrap’s performance during its initial cycle.

The Wrap Refresh Decision Matrix

Use this decision table when evaluating your wrap between Years 4–7:

| Wrap Condition | Brand Status | Recommended Action |

| Excellent (95%+) | Brand unchanged | Keep until Year 7–8 (maximize ROI) |

| Fair (75–85%) | Brand unchanged | Partial refresh (sides + rear panels) |

| Good (85%+) | Rebranded (new logo, colors) | Full rewrap, even if vinyl is fine |

| Poor (<75%) | Rebranded | Remove + full rewrap immediately |

| Fading/peeling | Any brand state | Replace: declining credibility reduces ROI |

Why rebrand early?

If your brand identity changes, outdated graphics actively work against you. Customers become confused, recognition resets, and impressions drop in value.

Rolling Refresh Strategy for Fleets (Avoid Huge Year 5–7 Costs)

If you wrap multiple vehicles at once (Year 0), you face a significant budget spike 5–7 years later when all wraps expire simultaneously.

A more innovative approach: staggered replacement.

Rolling Refresh Example: 10-Vehicle Fleet

- Year 5: Refresh two vehicles

- Year 6: Refresh two vehicles

- Year 7: Refresh two vehicles

- Year 8: Refresh two vehicles

- Year 9: Refresh final two vehicles

Benefits

- Predictable annual spend instead of a $30k–$60k spike

- Fleet always looks partially renewed.

- Allows Version 2.0 and 3.0 improvements as data accumulates

- Easier scheduling, reduced downtime.e

This strategy is one of the most effective ways to protect your budget and enhance your fleet’s overall performance in the field.

Maintenance That Extends Wrap Life (and ROI) by 1–2 Years

Maintenance directly impacts ROI—poorly maintained wraps may fade or peel years early.

The Maintenance Protocol That Preserves ROI

- Wash every 2–4 weeks

Hand wash or touchless wash only. Brush car washes damage edges.

- Avoid prolonged UV exposure.

Park in the shade when possible — UV is the number one cause of fading.

- Avoid pressure washing edges.

High-pressure jets lift seams and edges.

- Use wrap-safe wax once per year.

Adds UV protection and color vibrancy.

- Fix the lifting edges immediately.

A minor issue can escalate into a major failure within weeks.

Impact: Extending wrap lifespan from 5 to 7 years increases total ROI by 40% with zero additional design cost.

Common Mistakes That Quietly Kill Wrap ROI

Most wrap underperformance isn’t caused by bad design or low mileage — minor, avoidable operational errors are the primary cause.

Common Mistakes That Kill Wrap ROI

1. Parking vehicles out of sight

- Behind building

- Inside garage

- In a fenced yard with no visibility

A wrap parked out of public view loses hundreds of thousands of impressions annually.

2. Letting design override readability

Fancy gradients, small scripts, and “creative” layouts look great on screens—but fail at 40 MPH.

Design must prioritize:

- Legibility

- Contrast

- CTA size

- Simplicity

3. Not training staff on driving professionalism

A wrap increases accountability. Poor driving harms trust.

4. Zero tracking

If you don’t track anything, you’ll underestimate ROI by 30–50%.

5. Wrong CTA or too many CTAs

- Hard-to-read phone numbers

- Busy service lists

- No URL or QR code

- Mixed messages

A confused viewer takes no action.

Long-Term Business Impact: The Hidden ROI Multipliers

The benefits of a wrap go far beyond the direct jobs attributed to vehicle exposure.

1. Higher Close Rates from Brand Familiarity

A customer who has seen your van around town is predisposed to trust you.

This increases:

- Response rates

- Quote acceptance rates

- Willingness to pay

- Long-term retention

2. Higher Referral Rates

Your presence in a neighborhood acts as social proof.

Neighbors think:

“If they’re working for my neighbor, they must be reputable.”

3. Stronger Recruiting Signal

Wrapped vehicles communicate:

- Stability

- Professionalism

- Scale

- Growth

Technicians and drivers are more likely to apply when they see polished branding.

4. Better Employee Morale

Your team feels proud driving a clean, professionally wrapped vehicle. It elevates the brand internally and externally.

5. Compounding Exposure Year After Year

Every vehicle becomes a hyper-local brand-building loop:

Visibility → Familiarity → Trust → Preference → Price Power → Growth

This compounding effect, which lasts 5–7 years, often outperforms any other offline channel.

How BlinkSigns Helps You Maximize Vehicle Wrap ROI

Most wrap vendors focus on graphics.

BlinkSigns focuses on performance.

We design, implement, and optimize vehicle graphics as long-term revenue assets, not one-time decorative installs.

1. ROI-Focused Creative Principles

Our design process ensures every element supports visibility and conversion:

- Phone numbers sized for 50+ foot readability

- High-contrast colors that pop in motion

- 10-words-or-less messaging

- Side + rear CTA dominance (where most attention occurs)

- Layouts engineered for real-world driving angles.

We don’t design for portfolios—we design for results.

2. Route & Territory Consultation

We help identify:

- High-frequency corridors

- High-density neighborhoods

- Parking strategies that multiply impressions

- Seasonal patterns that boost exposure

These small changes compound ROI quickly.

3. Tracking Setup & Attribution Guidance

We help teams set up:

- Dedicated vehicle-only phone numbers

- Tracked landing pages or short URLs

- Proper QR code sizing and placement

- “How did you hear about us?” intake workflow

- Branded search and direct traffic monitoring

This transforms wraps from “branding expense” to “measurable channel.”

4. Lifecycle Management & Refresh Planning

For fleets, we provide:

- Staggered refresh schedules

- Version 2.0 and 3.0 design improvements

- Maintenance protocols

- Material selection

- Cost planning and ROI projection

Your vehicles remain sharp, consistent, and strategic.

Contact us today for consultation ➠

FAQs

1. How long does a vehicle wrap last?

Most wraps last 5–7 years, depending on factors such as maintenance, climate, and sun exposure.

2. How many impressions does a vehicle wrap get per day?

Typical ranges:

- Urban: 40,000–70,000/day

- Suburban: 20,000–40,000/day

- Rural: 5,000–15,000/day

3. What is a realistic ROI for a vehicle wrap?

Most service businesses see 300–800% ROI over the wrap lifespan. High performers exceed 1,000%.

4. What affects wrap ROI the most?

- Route density

- Vehicle miles

- Parking habits

- Design clarity

- Tracking/attribution

- CTA visibility

5. Do wraps work better for some industries than others?

Yes. Home services, landscaping, cleaning, HVAC, delivery, and local retail typically see the fastest ROI.

6. How do I track vehicle wrap leads?

Use:

- Dedicated phone numbers

- Custom URLs

- QR codes

- CRM intake questions

7. Is a vehicle wrap better than digital ads?

Wraps usually deliver lower CPM than Google or Meta, and last 5–7 years with no recurring fees.

8. How much does a vehicle wrap cost?

Typical single-vehicle costs:

- $2,500–$5,500 depending on size, coverage, and materials.

9. What’s the payback period for a wrap?

Often 3–12 months for service companies, depending on job values and margins.

10. How often should I refresh my vehicle wrap?

Most businesses refresh their look every 5–7 years, or sooner if they undergo a rebranding.

11. Does the wrap reduce vehicle resale value?

No wraps protect paint and can increase resale value by preventing sun damage and scratches.

12. What’s the best CTA for vehicle wraps?

A large phone number or short URL. QR codes are supplemental but useful.

13. Can weather damage the wrap?

Sun + heat = fading. Salt + snow = edge lifting. Proper maintenance prevents both.

14. Should every vehicle in the fleet be wrapped?

Not necessarily. Start with:

- Highest-mileage vehicles

- Those in high-traffic routes

- Customer-facing units

15. Do wrapped vehicles attract more attention than billboards?

Often yes—because they move, repeat exposure, and appear in everyday neighborhoods.

Final Thoughts

A great wrap does three things:

- Builds awareness everywhere your vehicles go

- Generates leads without ongoing spend

- Strengthens brand trust and perception

However, the real power lies in treating wraps as ROI-generating assets, not mere decorations.

With innovative design, optimized routes, intentional parking, and proper tracking, your vehicles can outperform most traditional advertising at a fraction of the cost—year after year.