Commercial Fleet Graphics: Turning Every Vehicle into a Mobile Billboard

Most companies already own a media channel they barely think about: their vehicles.

Those vans, trucks, trailers, and cars are out on the roads every day, driving past homes, job sites, office parks, restaurants, schools, and industrial parks. People are seeing them anyway. The real question is:

Are those vehicles quietly blending into traffic, or are they working like a disciplined, always-on advertising campaign?

This guide walks you through how to treat commercial fleet graphics as a serious marketing channel, not an afterthought:

- How to compare fleet wraps to billboards, radio, and digital ads

- How to calculate real ROI (not just “lots of impressions”)

- How many vehicles do you actually need to wrap

- What kinds of graphics make sense for your business model

- How to build a message that people can read in three seconds at 35 mph

This isn’t a design inspiration piece. It’s a playbook for owners, marketers, and fleet managers who want every vehicle to earn its keep as a mobile billboard.

Why Fleet Graphics Are One of the Most Cost-Effective Advertising Channels

Most paid media works like rent:

Stop paying → visibility disappears.

Fleet graphics are different:

- You pay once for the wrap.

- The assets run for 3–7 years.

- The “media cost” effectively trends toward zero.

And unlike billboards that sit in one location, fleet vehicles move through the exact neighborhoods and commercial districts you actually serve.

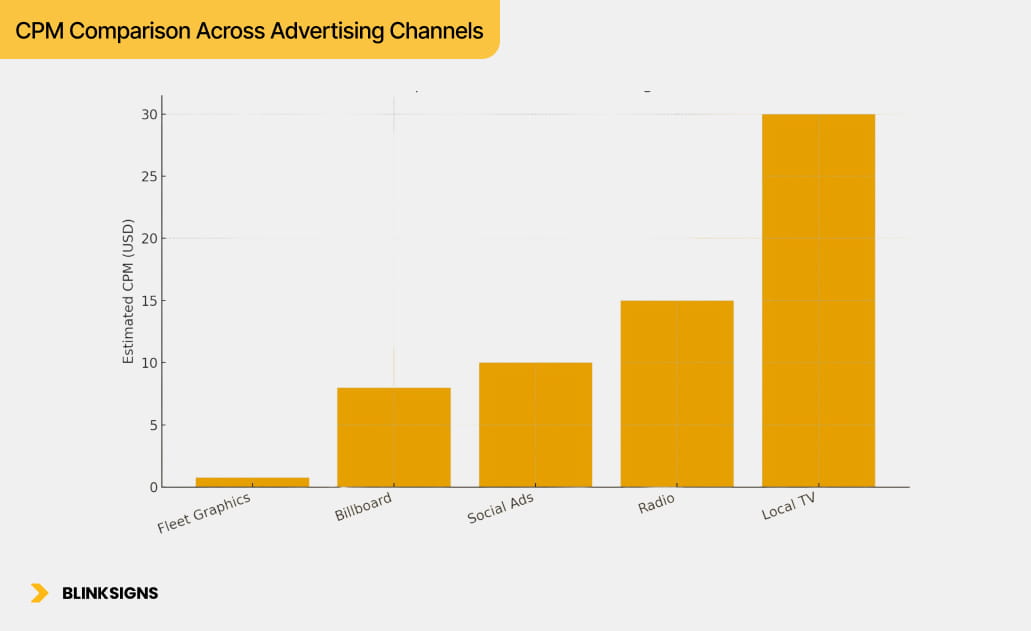

Fleet Graphics vs. Other Advertising Channels (CPM Comparison)

To compare apples to apples, it helps to look at CPM — cost per 1,000 impressions.

These numbers are directional, but they reflect typical ranges for local/regional campaigns.

| Channel | Typical CPM* | Reach Characteristics | Best For |

| Fleet Graphics | $0.35–$1.50 | Local, repeated exposure along real routes | Service businesses, delivery, trades, local B2B |

| Billboards (OOH) | $3–$12 | Fixed location, depends on traffic & placement | Broad awareness in one corridor |

| Facebook/Instagram | $5–$15 | Hyper-targeted but crowded feed; ad fatigue is real | E-commerce, lead gen, remarketing |

| Radio (Local) | $10–$20 | Audio only, attention varies by time slot | Promotions, time-sensitive offers |

| Local TV | $20–$40 | Shrinking but still broad; high production costs | Established brands, political, and mass awareness |

*CPM = cost per 1,000 impressions

CPM Comparison Across Advertising Channels

Key takeaway: When you spread the cost of a professional wrap over its whole lifespan, fleet graphics are often 5–10x more cost-efficient than traditional ads—and they give you physical presence in your operating area.

Fleet Graphics ROI: How to Measure Visibility & Business Impact

“Fleet wraps are great exposure” sounds nice, but it doesn’t help a CFO sign a PO.

You need straightforward, defensible math.

Impression Modeling Framework

Start with a basic impression estimate per vehicle:

Daily Impressions = (Daily Miles Driven) × (Average Vehicles/People Exposed Per Mile) × (Visibility Factor)

Where:

- Daily miles driven = how far the vehicle typically travels.

- Vehicles/people per mile = based on route type (urban, suburban, highway)

- Visibility factor (0.3–1.0) accounts for:

- Time in traffic vs. parked

- Time at high-visibility locations

- Weather, time-of-day mix, etc.

- Time in traffic vs. parked

Example (simple):

- 60 miles/day

- 20 people/vehicles exposed per mile

- Visibility factor: 0.7

Impressions/day = 60 × 20 × 0.7 = 840

Impressions/year ≈ 840 × 300 working days = 252,000

Now multiply by your fleet size.

CPM Calculation vs. Billboards & Digital Ads

Once you have annual impressions, CPM is straightforward:

CPM = (Total Wrap Investment ÷ Total Impressions Over Lifespan) × 1,000

Example:

- Wrap investment per van: $3,000

- Lifespan: 5 years

- Impressions/year: 250,000

- Total impressions: 250,000 × 5 = 1,250,000

CPM = (3,000 ÷ 1,250,000) × 1,000 ≈ $2.40

That’s before you account for:

- Brand lift

- Word-of-mouth

- “I saw your truck and called referrals.

And if the wrap lasts 7 years instead of 5, CPM drops further.

ROI Formula (Revenue Impact)

Visibility is nice. Revenue is better.

You can model revenue impact in a simple chain:

Impressions → Website/Calls → Leads → Customers → Revenue

- Impression → response rate (tiny, but compounding)

- Response → lead conversion rate (inbound calls, form fills)

- Leads → customer close rate

- Average revenue per new customer

Example:

- Fleet of 10 vehicles

- 250,000 impressions/vehicle/year = 2.5M impressions/year

- Response rate: 0.03% → 750 responses (site visits, calls, QR scans)

- Lead conversion rate: 30% → 225 leads

- Close rate: 25% → ~56 new customers

- Average revenue per new customer: $800

Annual revenue from fleet graphics ≈ 56 × 800 = $44,800

If your total wrap investment was $30,000 and your wraps run 5 years:

- 5-year revenue impact ≈ $224,000

- Simple ROI multiple ≈ 7.5x

This isn’t a guarantee. However, it demonstrates how to frame fleet wraps as a media investment, not just a paint job.

Measuring Real Fleet Impressions: GPS / Telematics Integration

Measuring Real Fleet Impressions

Most impression estimates use averages and guesswork.

If you’re serious about data, you can go deeper.

Traditional Impression Estimation (Industry Standard)

Most vendors use:

Miles driven × generic traffic factors

- Pros: Simple, fast, okay for ballpark numbers

- Cons: Doesn’t reflect your actual routes, your actual traffic mix, or time-of-day patterns

Accuracy is often ±30–50%.

GPS / Telematics-Based Impression Tracking (A Smarter Method)

If your fleet uses GPS or telematics (Samsara, Geotab, Verizon Connect, etc.), you have a much better option:

- Export actual route traces (latitude/longitude over time)

- Overlay those traces on traffic density data (historic or average)

- Apply visibility assumptions based on road type and time of day.

Now your impression estimates are based on where your vehicles actually drive, not theoretical averages.

Benefits:

- More accurate CPM

- Zone-level insight (which neighborhoods see you the most)

- A defensible story for finance and leadership

Zone-Specific Impression Modeling

Not all miles are equal.

- 10 miles in downtown at rush hour ≠ , 10 miles on a rural highway

- 30 minutes parked in front of a busy job site ≠ , 30 minutes at a depot

With GPS + traffic data, you can:

- Segment your routes into zones (downtown, suburbs, industrial, residential)

- Estimate impressions per zone

- Identify high-value corridors to prioritize for route planning and development.

This is especially powerful for:

- Delivery and logistics brands

- Franchise networks

- Service companies with defined territories

Business Applications

Once you have route-based impression data:

- CFOs get an absolute media cost baseline

- CMOs can compare fleet CPM with Google Ads, social, and OOH.

- Fleet managers can optimize routes for both operational efficiency and marketing purposes.

- Franchise owners can benchmark territory visibility across locations.

Implementation Guide (Simple Version)

You don’t need a custom data science team to start:

- Confirm the telematics provider and export capabilities

- Export 30–60 days of route data for a sample group of vehicles

- Work with a partner (such as BlinkSigns and data vendors) to overlay traffic density.

- Build a simple dashboard:

- Impressions by vehicle

- Impressions by zone

- Impressions by time-of-day

- Impressions by vehicle

- Translate into marketing metrics:

- Fleet-wide impressions

- Cost per impression

- Cost per 1,000 impressions

- Fleet-wide impressions

Even a basic version of this provides a significant advantage in budget discussions.

Fleet Size Strategy: How Many Vehicles Should You Wrap?

The honest answer is: not always “all of them.”

Fleet graphics perform best when they create enough density in your market to be noticed repeatedly, without blowing up your budget.

Impression Density Calculation

Think about:

- Service area size (single city vs. metro vs. multi-state)

- Number of daily active vehicles

- Average daily miles per vehicle

- Traffic type (urban vs. suburban vs. highway)

You’re aiming for:

“People in our service area can’t go a week without seeing us at least once.”

Rough guidance:

- Local service businesses (HVAC, plumbing, landscaping)

- Often: wrap 100% of customer-facing vehicles.

- Often: wrap 100% of customer-facing vehicles.

- Delivery/logistics (10–50 vehicles)

- Usually: 70–100% coverage, starting with the highest-mileage routes

- Usually: 70–100% coverage, starting with the highest-mileage routes

- Larger fleets (50–200+)

- Initially: 50–70%, then scale based on proven ROI

- Initially: 50–70%, then scale based on proven ROI

- Mixed fleets (service + admin)

- Wrap every vehicle that leaves the lot daily, skip pool/admin cars.

- Wrap every vehicle that leaves the lot daily, skip pool/admin cars.

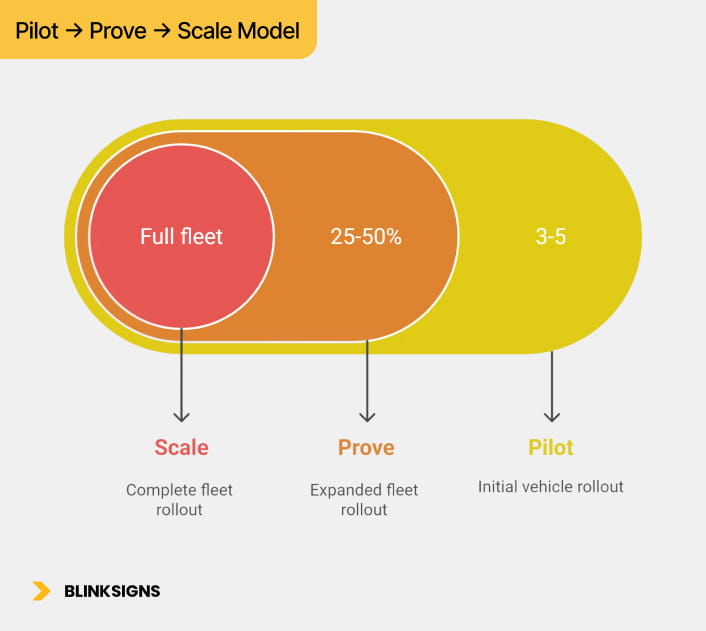

Pilot → Prove → Scale Model

To mitigate risk, especially for fleets of 10 or more vehicles, consider a three-phase rollout.

Fleet Wrap Rollout Phases

Phase 1: Pilot (3–5 vehicles)

- Wrap the highest-visibility, highest-mileage vehicles

- Track for 3–6 months:

- Website visits from fleet-specific URL/QR

- Calls mentioning “I saw your truck.”

- Local brand recall questions in surveys

- Website visits from fleet-specific URL/QR

- Goal: Validate baseline response and internal buy-in

Phase 2: Prove (25–50% of fleet)

- Expand to 25–50% of the working fleet

- Standardize templates and message hierarchy.

- Document installation, maintenance, and tracking processes

- Goal: Confirm scale performance and operations impact

Phase 3: Scale (Full fleet coverage)

- Integrate wraps into the vehicle acquisition/replacement process

- Maintain brand consistency and refresh schedules.

- Treat fleet graphics as a permanent media channel.

When NOT to Wrap Your Full Fleet

Complete coverage isn’t always witty.

Consider partial coverage when:

- Vehicles are due for replacement within 12–18 months

- Certain vehicles rarely leave private property.

- You’re entering a new market and want to test before committing.

- Budget is constrained, and you need to prioritize

In that case, focus wraps on:

- Highest-mileage vehicles

- Most visible routes

- Service vehicles that park on streets or at job sites

- Vehicles that spend time in target-rich neighborhoods

Choosing the Right Type of Fleet Graphics

Not every vehicle needs a complete, cinematic wrap. Sometimes a well-designed partial or spot package performs just as well.

Type of Fleet Graphics

Full Wraps

- Coverage: 90–100% of painted surfaces

- Best for:

- Newer vehicles in good condition

- Bold, image-heavy designs

- Brands building strong local presence

- Newer vehicles in good condition

- Pros: Max impact, perceived professionalism, paint protection

- Cons: Higher upfront cost, more downtime for installation

Partial Wraps

- Coverage: 30–70% of vehicle surfaces

- Strategic use of body color + graphic panels

- Best for:

- Solid brand colors similar to OEM paint

- Budget-conscious fleets

- Clean, message-first layouts

- Solid brand colors similar to OEM paint

- Pros: Lower cost, shorter install time, still highly visible

- Cons: Less “wow” factor than full wraps if poorly designed

Spot Graphics & Decals

- Coverage: Logos, contact details, web/QR, key message

- Best for:

- Older vehicles or short-term leases

- Admin or pool vehicles you still want branded

- Older vehicles or short-term leases

- Pros: Lowest cost, quick install, easy to update

- Cons: Limited visual storytelling, less dominant in traffic

Reflective Vinyl for Night Visibility

- Use cases:

- Night-time delivery

- Emergency services

- 24/7 operations

- Night-time delivery

- Applies as accents, outlines, or full coverage in some applications

- Helps vehicles stand out in low-light conditions and improves safety

Seasonal & Campaign Graphics: When Permanent Isn’t the Answer

Some businesses need message flexibility as much as they need brand presence.

Think:

- HVAC: heating vs. cooling season

- Landscaping: mowing vs. leaf removal vs. snow removal

- Retail/food: holiday promos, limited-time offers

- Event and rental companies: seasonal campaigns

Tools you can use:

Magnetic Panels

- Attach to steel panels on doors/side surfaces

- Great for short campaigns or rotating offers

- Pros: Easy on/off, reusable

- Cons: Limited to flat, magnetic-friendly areas; not theft-proof

Removable Vinyl

- Designed for 1–2 year deployment

- Cleaner removal than long-term films

- Pros: Seamless look, more design freedom than magnets

- Cons: Higher cost than magnets, still requires installation/removal time.

Modular Panel Systems

- Permanent base wrap (core brand)

- “Swappable” printed panels or overlays for offers/events

- Pros: Strong brand presence + flexible messaging

- Cons: Requires planning and a clever layout in the initial design

Hybrid strategy example (HVAC):

- Base wrap: logo, brand colors, website, phone number

- Seasonal add-ons on doors or rear:

- Winter: “Furnace Tune-Up Special”

- Summer: “AC Check-Up – Stay Cool All Season”

- Winter: “Furnace Tune-Up Special”

Result:

You get the long-term ROI of a permanent wrap plus the responsiveness of campaign media.

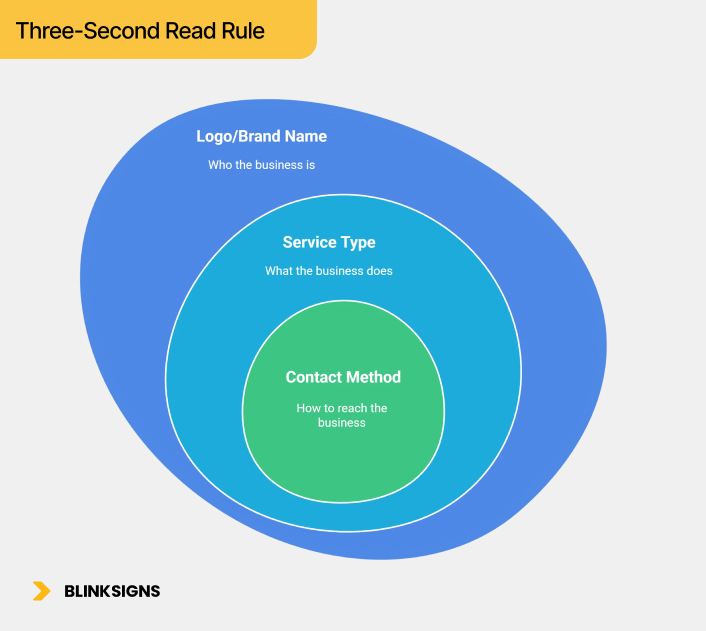

Fleet Graphics That Work: Message Hierarchy & Design Strategy

Most fleet wraps fail in the wild because they try to say too much.

You have about three seconds as a vehicle passes by or as someone glances out a window. Your design needs a clear and concise message hierarchy.

The Three-Second Read Rule

Three-Second Read Rule

Your vehicle should answer three questions almost instantly:

- Who is this?

- Logo/brand name

- Logo/brand name

- What do they do?

- One short descriptor: “Plumbing & Drain,” “Commercial Roofing,” “Same-Day Delivery.”

- One short descriptor: “Plumbing & Drain,” “Commercial Roofing,” “Same-Day Delivery.”

- How do I reach them?

- Phone number OR short web/URL OR clear QR code

- Phone number OR short web/URL OR clear QR code

Everything else is optional.

Good three-second hierarchy:

- Big logo

- Clear service type

- One primary contact method

Bad three-second hierarchy:

- Taglines, mission statements, product lists, social icons, long URLs, tiny fonts, ten colors, five messages.

Avoid costly wrap mistakes — download the fleet graphics checklist ↴

Readability at 35 mph

People don’t read fleet graphics in ideal conditions. They read them:

- At an angle

- Through rain

- In motion

- With kids yelling in the back seat

Some simple rules:

- High contrast: Dark text on light background or vice versa

- Sans-serif fonts: Clean, bold, minimal stroke variation

- Size: Phone number and URL large enough to read from 50–75 feet

- Avoid: Script fonts, thin strokes, low-contrast color combos, cluttered backgrounds.

Where possible, test your design by:

- Printing at scale

- Viewing from across a parking lot

- Taking a quick photo from a moving car (with a safe driver, of course)

If it’s not instantly legible, it’s not ready.

QR Codes & Digital Pathways

QR codes can be effective on vehicles—if used correctly.

Best practices:

- Place QR codes on the rear and side panels, not low on the bumper

- Keep enough clear space around them for scanners.

- Use short, branded URLs behind the QR (for tracking and memorability)

- Send scanners to a mobile-optimized landing page, not your generic homepage.

Smart uses:

- “Track your technician” pages

- Quote request landing pages

- App download pages

- “New customer offers” pages.

Every QR scan should be measurable, allowing you to attribute traffic back to the fleet.

Industry-Specific Fleet Graphics Strategies: Matching Design to Business Model

Not every fleet has the same job.

Your business model should shape your fleet messaging.

Industry-Specific Fleet Graphics Strategies

Service Industries (HVAC, Plumbing, Electrical, Landscaping)

Primary goal: Make the phone ring.

Design priorities:

- What you do: “24/7 Plumbing & Drain,” “Heating & Cooling,” “Tree Care & Removal”

- Clear phone number

- Service area cues (“Serving Greater [City]”)

- Trust signals (licensed, insured, years in business, maybe one key badge)

Coverage recommendation:

- Wrap 100% of service vehicles that visit homes or job sites

Message hierarchy:

- Service type

- Phone number

- Brand name/logo

Delivery & Logistics (Food, Courier, Last-Mile, eCommerce)

Primary goal: Brand recognition + digital engagement.

Design priorities:

- Strong logo recognition from far away

- App/brand recall (“Order on the App”, “Available on [Platforms]”)

- QR codes or short URLs for tracking and offers

Coverage recommendation:

- Typically, 70–100% of the fleet, especially those in dense urban areas

Message hierarchy:

- Brand logo

- Value prop (“Hot Food Fast,” “Same-Day Delivery”)

- Digital call-to-action (app, QR, site)

Construction & Contractors (GC, Roofing, Remodeling, Concrete, etc.)

Primary goal: Neighborhood saturation around job sites.

Design priorities:

- Clear trade (“Roofing & Gutters,” “Commercial Concrete,” “Remodeling”)

- Strong contact (phone + web)

- Visuals that look solid and trustworthy, not gimmicky

Coverage recommendation:

- Wrap every truck that parks at job sites or on streets

Message hierarchy:

- Trade/service

- Trust and credibility (years, license)

- Contact details

Key advantage: Your trucks are often parked in front of projects for hours or days.

That’s free, hyper-targeted advertising to neighbors.

B2B Sales & Field Service (Equipment, Industrial Services, Pharma, IT, etc.)

Primary goal: Professional presence at client sites.

Design priorities:

- Clean, restrained branding (no loud, cartoonish graphics)

- Emphasis on brand name and niche

- Subtle tagline or descriptor

Coverage recommendation:

- 100% of client-facing vehicles, even if modestly branded

Message hierarchy:

- Brand name

- Short description (“Industrial Automation,” “Managed IT Services”)

- Website

These vehicles often park in serving, serving as billboards to other potential business clients in the same park.

Franchise Fleets (Home Services, QSR Delivery, Multi-Location Brands)

Primary goal: Brand consistency + local relevance.

Design priorities:

- 80% fixed corporate template (colors, layout, logo, main message)

- 20% local customization (local phone, city/territory, franchise ID)

Coverage recommendation:

- Typically, 100% of the operating fleet is enforced via brand standards

Message hierarchy:

- Corporate brand

- Local contact

- Area/territory reference

Done well, franchise fleets can make a brand feel huge in a city long before mass media catches up.

Fleet Graphics Maintenance: Protecting Your Investment & Brand Perception

Most owners treat wraps as a one-time project. Fleet managers know better: how you care for those vehicles determines whether you get 3 years or 7 years out of the graphics.

And it’s not just durability. Poorly maintained wraps make your company look tired long before the vinyl actually fails.

Fleet Wrap Maintenance and Lifecycle Management

The Business Case for Systematic Maintenance

Without a plan, this is what usually happens:

- Road film, dust, and salt sit on the vinyl for months

- UV damage accelerates because grime acts like sandpaper, causing it to wear away more quickly.

- Edges start lifting, especially around doors and wheel arches.

- Colors fade unevenly; darker colors go dull first.

Result:

- Wraps that could look sharp in Year 5 look tired in Year 3

- Crews drive around in vehicles that silently say, “We don’t care about details.”

With consistent maintenance:

- Wraps stay crisp for 5–7+ years

- Your annualized cost per vehicle drops sharply.

- You avoid the “brand decay” phase, where the wrap is still physically there but visually dragging you down.

Think of maintenance as protecting a media asset, not “washing the truck.”

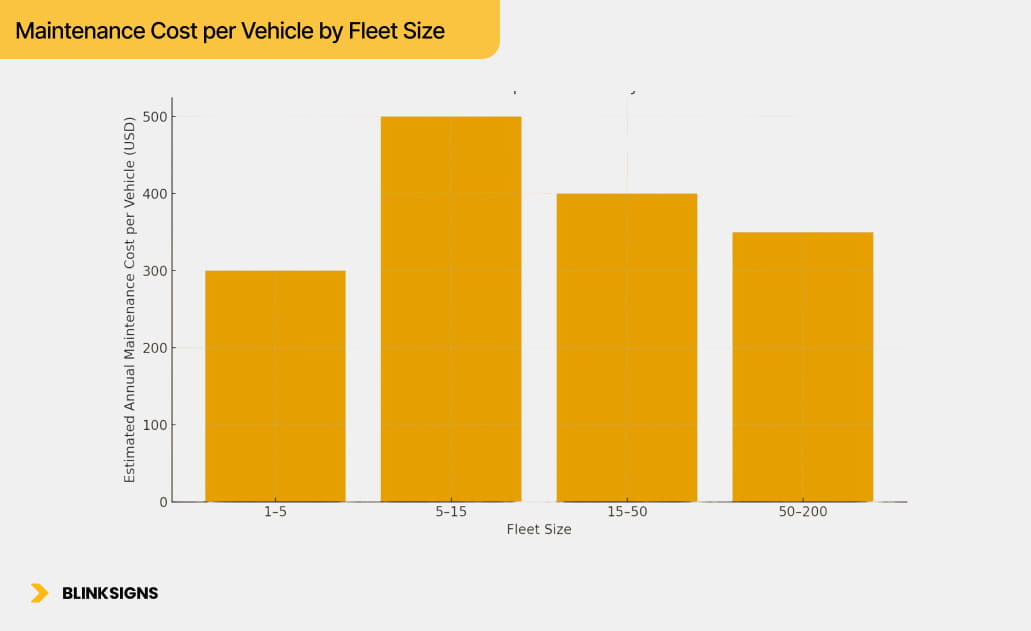

Fleet Maintenance Models by Fleet Size

You don’t need the same setup for three vehicles as you do for 150. Here’s a practical way to think about it.

Small Fleets (1–5 Vehicles)

Model A: Driver-Responsible Cleaning

- Frequency: Weekly wash, quick rinse mid-week if needed

- Method:

- Bucket or low-pressure hose

- pH-neutral soap

- Soft mitt or sponge (no stiff brushes)

- Bucket or low-pressure hose

- Time: ~20–30 minutes per vehicle

- Annual cash cost: Low (mainly soap, mitts, microfiber towels)

Best when:

- Service vehicles go home with drivers

- You can set expectations and conduct spot checks to ensure compliance.

Model B: Touchless Car Wash Program

- Frequency: Every 2 weeks (more often in winter/salty climates)

- Type: Touchless only — rotating brushes can damage vinyl edges

- Cost: Roughly $15–25/visit

Best when:

- Vehicles return to a central location

- You want minimal time overhead for drivers.

Medium Fleets (5–25 Vehicles)

Model C: Mobile Wash Service

- Frequency: Every 2–4 weeks, on-site

- Method: A contractor washes all vehicles at your yard or lot

- Cost: Often in the range of $20–40/vehicle/visit

- Time: Zero management of hoses, supplies, and drains

Best when:

- Vehicles park at a depot

- You don’t want to maintain the wash infrastructure.

Model D: Simple On-Site Wash Bay

- Setup:

- Designated wash area

- Pressure washer with appropriate nozzles

- Storage for soaps, mitts, drying towels

- Designated wash area

- Staffing:

- One part-time resource or shared maintenance staff

- One part-time resource or shared maintenance staff

- Cost: Higher setup, lower long-term per-vehicle cost

Best when:

- You already have a yard/lot

- Vehicles return to base every night.

Large Fleets (25–200+ Vehicles)

Model E: In-House Maintenance Program

- Components:

- 1 supervisor + wash/appearance team

- 1–2 wash bays with drainage/water reclamation where required

- 1 supervisor + wash/appearance team

- Rhythm:

- Weekly wash rotation: every vehicle is cleaned at least once/week

- Monthly inspection: note any edge lifting, scratches, or impact damage

- Quarterly “deep clean”: remove tar, apply approved protective products

- Weekly wash rotation: every vehicle is cleaned at least once/week

Best when:

- Brand appearance is critical (franchise, national brand, high visibility)

- Vehicles are always on the road, often in densely populated areas.

Model F: Hybrid Approach (In-House + Outsourced)

- In-house: Routine weekly wash

- Outsourced: Quarterly deep clean and spot repairs

Best when:

- You want reliable day-to-day cleaning

- You still want professional oversight on vinyl health.

Fleet Maintenance Models by Fleet Size

When to Spot Repair vs. Replace the Wrap

You don’t replace a vehicle because of one scratch; the same logic applies to wraps.

Spot repair usually makes sense when:

- Light edge lifting under 6–8 inches, in a few spots

- A small panel is damaged by impact or scraping.

- The rest of the wrap still looks visibly firm.

Complete replacement usually makes sense when:

- Multiple panels show peeling or cracking

- Fading is evident from a distance.

- Colors no longer match your current brand.

- You’re planning to run the vehicle for at least 2–3 more years.

A simple rule of thumb:

If repairs for a single vehicle will cost more than roughly 30% of a complete replacement, it’s usually smarter to schedule a full rewrap.

You avoid chasing minor fixes and reset that vehicle’s “brand clock” for another 5–7 years.

Fleet Graphics Lifespan: When “Still Functional” Becomes Off-Brand

Vinyl manufacturers typically quote a lifespan of 3 to 7 years. That’s a durability window, not a branding recommendation.

A vehicle wrap can be technically “fine” while quietly sending the message:

“This company doesn’t really keep up.”

The Fleet Wrap Degradation Curve

You can think of fleet graphics in four phases:

| Year Range | Visual Condition | Brand Perception | Action Focus |

| Years 0–2 | Excellent — vibrant, crisp | “Professional, sharp, actively investing.” | Routine washing |

| Years 2–4 | Good — mild, even fading | “Established, active, well-managed.” | Inspections, minor spot repairs |

| Years 4–6 | Acceptable — noticeable age | “Functional but aging; maybe behind on refresh” | Decide: refresh priority vehicles |

| 6+ | Poor — peeling/faded patches | “Neglected, possibly struggling or inattentive.” | Replace or remove graphics altogether |

Most brands start losing ground somewhere in the Years 4–6 window.

Even if the vinyl is technically intact, the visual tells a different story.

Replacement Decision Scenarios

Scenario 1: Year 2–4, Good Condition

- Mild, even fading

- No major peeling

- Messaging still accurate

Action:

Continue with routine cleaning and annual inspection. Plan for refresh around Years 5–6 for front-line vehicles in core markets.

Scenario 2: Year 4–6, Mixed Condition

- Some vehicles appear to be in good condition, while others exhibit clear signs of age.

- High-visibility vehicles look “okay,” not great.

Action:

- Prioritize replacements for:

- High-mileage vehicles in dense markets

- Trucks are regularly parked in visible spots (main roads, malls, busy job sites)

- High-mileage vehicles in dense markets

- Use spot repair for:

- Low-mileage vehicles

- Units due for replacement within 12–18 months

- Low-mileage vehicles

Scenario 3: Year 6+, Poor Condition

- Extensive peeling

- Fading obvious from 20–30 feet

- Outdated branding (old URLs, phone numbers, logos)

Action:

- For vehicles staying in service 2–3+ more years → full rewrap

- For vehicles near retirement in <12 months → remove wrap entirely rather than driving a rolling anti-ad

Financial Triggers for Refresh

Three practical triggers help you avoid emotional decisions:

- Repair > 30% of Replacement Cost

- If patching up one vehicle costs ~⅓ of a new wrap, schedule a refresh.

- If patching up one vehicle costs ~⅓ of a new wrap, schedule a refresh.

- Vehicle Lifecycle Window

- If a vehicle has less than 12 months of expected service life, don’t invest in a full rewrap.

- If it has 3+ years ahead, a fresh wrap can pay for itself again.

- If a vehicle has less than 12 months of expected service life, don’t invest in a full rewrap.

- Brand or Message Change

- New logo, updated color system, revised phone number, new URL, or repositioned service offering? Treat that as a challenging reset opportunity.

- New logo, updated color system, revised phone number, new URL, or repositioned service offering? Treat that as a challenging reset opportunity.

Refreshing wraps is not just maintenance—it’s a visible sign that your brand keeps pace with the market.

Multi-Vehicle Deployment: Installing 5–200 Vehicles Without Killing Capacity

For many fleet managers, the biggest fear isn’t the cost of wrapping—it’s the downtime.

“How do I get this done without breaking routes, missing appointments, or upsetting customers?”

What Downtime Actually Looks Like

Rough averages (per vehicle):

| Vehicle Type | Install Time | Curing & QC | Typical Total Downtime |

| Small car/sedan | 4–6 hours | 12–24 hours | 1.5–2 days |

| Cargo van | 8–12 hours | 12–24 hours | 2–3 days |

| Service truck | 10–16 hours | 12–24 hours | 2–3 days |

| Box truck/trailer | 16–24 hours | 24–48 hours | 3–4 days |

| Large bus/coach | 24–48 hours | 24–48 hours | 4–6 days |

You can’t compress curing without risk. Shortcuts lead to early edge failure and bubbles.

The solution: phasing.

Small Fleets (5–15 Vehicles): Rolling Rotation

Goal: Keep most vehicles running while quietly updating the fleet.

Approach: 2-Vehicle Rotation

- Week 1

- Mon PM: Drop off vehicles 1–2

- Tue–Wed: Install + cure

- Thu AM: Pick up and return to service

- Mon PM: Drop off vehicles 1–2

- Week 2: Repeat with vehicles 3–4

- Week 3: Vehicles 5–6

- And so on…

Impact:

- At any time, ~15–20% of the fleet is out of service.

- Zero rentals needed if you plan routes conservatively

- Drivers adapt for 1–2 days per cycle.

Best for:

- Trades, small service fleets, specialty logistics

Medium Fleets (15–50 Vehicles): Batch Installs + Route Redistribution

You have more vehicles, more routes, and higher stakes.

Phase 1: Pilot (3–5 units)

- Wrap a small group of vehicles first

- Validate design, installation quality, and driver feedback to ensure optimal performance.

Phase 2: Main Fleet (20–30 units)

- Wrap 4–6 vehicles per week in batches

- Redistribute routes among the remaining fleet temporarily.

- Consider limited rentals during the busiest weeks.

Phase 3: Support Vehicles (admin, low-priority)

- Wrap office, pool, or backup vehicles last

- Scheduling is more flexible.

Large Fleets (50–200+ Vehicles): Geographic & Asset-Type Phasing

Now, deployment becomes a project in its own right.

Phase by location + vehicle type:

- Flagship depot or region

- First 10–20 vehicles

- Highest visibility, easiest to monitor

- First 10–20 vehicles

- Additional depots, staggered.

- Each region gets a window (e.g., weeks 4–6, 7–9, 10–12)

- Wrap by type within that window: vans, box trucks, and specialty vehicles.

- Each region gets a window (e.g., weeks 4–6, 7–9, 10–12)

Guardrails:

- Do not pull more than ~20% of any one location’s fleet out of service at once

- Use vehicles from nearby depots to backfill if possible.

For large fleets, a single project manager (internally or via partner) keeps:

- Schedule

- Installers

- QC and documentation

- Communication with local managers

Seasonal Timing: When NOT to Schedule Installs

Every industry has crunch seasons. Don’t schedule wraps when you need every truck on the road.

Examples:

| Industry | Avoid Wrapping During | Better Windows |

| HVAC | Peak heat + peak cold | Shoulder seasons (spring/fall) |

| Landscaping | Late spring–early fall | Late fall–early spring |

| Construction | Core building months | Late fall, early winter (varies) |

| Retail delivery | November–December | January–February |

| Food delivery | Weekends & peak mealtimes | Mon–Wed mornings |

Align your schedule with known slow periods or planned maintenance to minimize downtime, making it feel like a single, coordinated event rather than a series of constant disruptions.

Temporary Capacity Solutions

When vehicles are off the road for wraps, you can:

- Consolidate routes

- Extend some routes slightly, use overtime strategically.

- Extend some routes slightly, use overtime strategically.

- Use rentals

- Accept that they won’t be branded, but protect service capacity.

- Accept that they won’t be branded, but protect service capacity.

- Shift non-urgent jobs

- Schedule work for the post-deployment period.

- Schedule work for the post-deployment period.

- Borrow across locations (large fleets)

- If one depot wraps six vehicles, pull 2–3 from a nearby depot temporarily

- If one depot wraps six vehicles, pull 2–3 from a nearby depot temporarily

The key is to treat fleet wrapping like scheduled maintenance, not an unexpected outage.

Compliance & Risk: DOT, Legibility, and Local Rules

Fleet graphics sit in the middle of branding, safety, and regulation.

You don’t need to be a legal expert, but you do need to avoid obvious mistakes.

Key considerations (always confirm with local rules):

- DOT Numbers & USDOT markings

- Must remain clearly visible and legible

- Maintain required contrast and minimum sizes.

- Must remain clearly visible and legible

- License plates & registration stickers

- Never obstruct or stylize these elements.

- Never obstruct or stylize these elements.

- Lights & reflectors

- Do not cover required reflectors, lights, or indicators.

- Do not cover required reflectors, lights, or indicators.

- Glass & visibility

- Many regions restrict the use of wraps on the front side windows and windshields.

- Rear and cargo windows may have more flexibility, but need caution.

- Many regions restrict the use of wraps on the front side windows and windshields.

A good fleet graphics partner will:

- Ask how and where your vehicles operate

- Confirm whether you run interstate, intrastate, or only locally.

- Help route artwork around numbers, plates, and light.s

- Use appropriate reflective materials where required or recommended.

Done right, graphics support safety and compliance rather than fighting them.

Scaling Fleet Graphics Across Locations: Core Kit + Local Flex

Once a single depot is dialed in, the next challenge is:

“How do we roll this out to multiple locations without reinventing the wheel each time?”

The answer is a core kit.

What a Core Kit Includes

Tier 1 – Non-Negotiables (Every Location Uses These As-Is)

- Primary logo placement and sizing rules

- Core color palette and fonts

- Key layout: side, rear, hood composition

- Required compliance placements (DOT numbers, reflective accents if used)

- Standard messaging elements (descriptor, URL/phone pattern)

Tier 2 – Local Adaptations (Within Brand Guardrails)

- Local phone number

- City/territory name

- Franchise ID or branch name

- Local imagery if appropriate (within color/contrast rules)

Tier 3 – Optional Enhancements

- Seasonal or campaign overlays

- Reflective upgrades for specific markets

- Extra decals for special programs (e.g., “Veteran Owned,” “Electric Fleet Pilot”)

With a core kit, you can:

- Keep every vehicle recognizably “on brand.”

- Allow branches and franchisees to feel represented.

- Reduce per-location design time (most work is already done)

Total Cost of Ownership: Looking Beyond the Wrap Price

A fleet wrap is not just a design + install line item. It’s a multi-year media asset.

You can think of the cost structure like this (per vehicle):

- Acquisition cost

- Design + production + installation

- Design + production + installation

- Maintenance cost

- Washing, occasional spot repairs

- Washing, occasional spot repairs

- Operational cost

- Downtime during install/refurbishment

- Downtime during install/refurbishment

- Refresh cost

- End-of-life rewrap, rebrand, or remove.

- End-of-life rewrap, rebrand, or remove.

Spread over 5–7 years, the annualized TCO is often modest relative to revenue impact.

Example (per vehicle):

- Wrap + install: $3,000

- Average lifespan: 6 years

- Annualized wrap cost: $500/year

- Maintenance (wash, minor touch-ups): say $150/year

- Occasional refresh toward Year 6: baked into next cycle

So, for perhaps $650/year, that vehicle functions as:

- Rolling billboard

- Brand signal at every job site

- Trust the cue in neighborhoods you serve

If one additional customer per two months covers that cost, you’re already in the black.

Choosing the Right Fleet Graphics Partner

You don’t want “someone who can print a large sticker.” You want a partner who understands:

- Fleet operations

- Brand governance

- Installation logistics across multiple vehicle types

- Long-term ROI and refresh planning

Questions to consider:

- Fleet experience

- Have they handled 10+ vehicle projects? 50+? 200+?

- Do they understand how installations affect capacity?

- Have they handled 10+ vehicle projects? 50+? 200+?

- Design for fleets (not just for static signage)

- Do they consider sight lines, panel breaks, and door seams?

- Do they prototype legibility at distance and speed?

- Do they consider sight lines, panel breaks, and door seams?

- Materials & warranty

- Are they working with reputable films and laminates suited to your climate?

- Can they explain the difference between short-term and long-term materials?

- Are they working with reputable films and laminates suited to your climate?

- Installation network

- Can they support all locations where your vehicles operate?

- How do they handle QC and rework if something goes wrong?

- Can they support all locations where your vehicles operate?

- Governance & documentation

- Will they provide templates, specs, and a core kit for future vehicles?

- Do they keep print and color records for consistent reorders?

- Will they provide templates, specs, and a core kit for future vehicles?

- Measurement & follow-through

- Are they open to helping design your tracking plan (URLs, QR, surveys)?

- Do they schedule reviews after the initial rollout?

- Are they open to helping design your tracking plan (URLs, QR, surveys)?

The right partner doesn’t just “wrap trucks.” They help you run a fleet media program.

How BlinkSigns Supports Commercial Fleet Programs

This is where a partner like BlinkSigns fits in.

A mature fleet program needs more than production capacity. It needs:

- Strategy: Clarifying goals (awareness, inbound calls, app usage, franchise consistency)

- Design: Building systems that work across vehicle types and cities

- Operations: Scheduling installs with minimal disruption

- Governance: Keeping every new vehicle on spec without endless redesign

- Lifecycle: Planning refresh cycles and maintenance standards

A typical BlinkSigns engagement might include:

- Fleet discovery: types, quantities, routes, and locations

- Message and design workshop with marketing + operations

- Creation of a fleet graphics core kit (templates + specs)

- Pilot rollout and tracking plan

- Multi-location scaling plan (phased installs, seasonal timing)

- Routine refresh and maintenance planning

By treating your fleet as a media channel, not just an asset column, BlinkSigns helps keep every vehicle working on two jobs:

- Getting your products, people, and tools where they need to go

- Building your brand every mile of the way

👉Download the Commercial Fleet Graphics Strategy Guide (PDF) ↴ 👉Book a fleet strategy call with BlinkSigns 🕻

Frequently Asked Questions

How long do fleet wraps actually last?

Most professionally installed fleet wraps last five to seven years. That assumes normal driving conditions and basic care. If vehicles are parked outdoors full time, driven heavily, or exposed to extreme heat or cold, expect performance closer to the five year mark.

Will wrapping damage my vehicle’s paint?

On factory painted vehicles in good condition, wraps usually protect the paint from sun exposure and light wear. Issues only happen when vinyl is applied over poor surfaces like peeling paint, rust, body filler, or non factory repainting. In those cases, paint can lift during removal.

Is a full wrap always better than a partial wrap?

Not always. A well designed partial wrap on a vehicle with a suitable base color can deliver strong visibility at a lower cost. Full wraps make more sense when you want maximum brand dominance or when paint protection across the entire vehicle matters.

How many vehicles should we start with?

For larger fleets, it works best to start small and scale. Many companies begin with three to five vehicles, then expand to a portion of the fleet before rolling out fully. Smaller fleets often brand all customer facing vehicles from the start to stay consistent.

How do we track ROI from fleet graphics?

Most businesses track performance using a mix of impression estimates, dedicated URLs or QR codes, and simple questions like “How did you hear about us?” Comparing inbound calls, brand recognition, and close rates before and after the rollout gives the clearest picture. Larger fleets sometimes layer in GPS and traffic data for route based estimates.

Can we wrap older vehicles?

Yes, as long as the vehicle body is solid and the paint is stable. If paint is cracking or rust is present, vinyl will not hide it and may struggle to adhere. For vehicles nearing end of life, lighter branding or spot graphics often make more sense than a full wrap.

What about electric or hybrid vehicles?

Electric and hybrid vehicles can be wrapped just like traditional vehicles. Installers need to take extra care around sensors, charging ports, and safety markings. From a branding standpoint, wrapped EV fleets often help reinforce sustainability and innovation messaging.

How do we handle fleets across multiple cities or states?

Consistency comes from having a single playbook. That includes approved layouts, materials, colors, and placement rules. A central partner oversees production and approvals while local installers execute from the same standards so every vehicle looks like part of one brand.

Are fleet wraps removable?

Yes. When quality materials are used and the wrap is removed within its expected lifespan, removal is usually clean and straightforward. Older wraps can still be removed but may take more time and surface preparation.

Can we update part of a wrap if our phone number or website changes?

Often yes. If the design includes modular sections such as contact panels, those areas can be replaced without rewrapping the entire vehicle. This is why planning during the design phase saves money later.

How long does a full fleet rollout take?

Timelines depend on fleet size and vehicle availability. Small fleets may be completed within a few weeks. Medium fleets usually take several months with phased installs. Large multi location fleets are often scheduled over longer periods to avoid disrupting operations.

Is reflective vinyl worth the extra cost?

For night driving, roadside work, or service vehicles operating in low light, reflective vinyl is often worth it. You do not need full coverage. Even selective reflective accents can improve visibility and safety without significantly increasing cost.

Your Fleet Is Already on the Road — Make Sure It’s Working for You

You’re already paying for:

- Vehicles

- Fuel

- Insurance

- Drivers

- Maintenance

The only question is whether those vehicles are just moving assets around…

Or quietly building your brand every mile they drive and every minute they’re parked.

With a clear strategy, disciplined design, thoughtful deployment, and long-term maintenance, commercial fleet graphics turn every vehicle into a predictable media asset:

- Consistent local presence

- Trust at the curb and on the job site

- A steady stream of “I saw your truck and called” moments